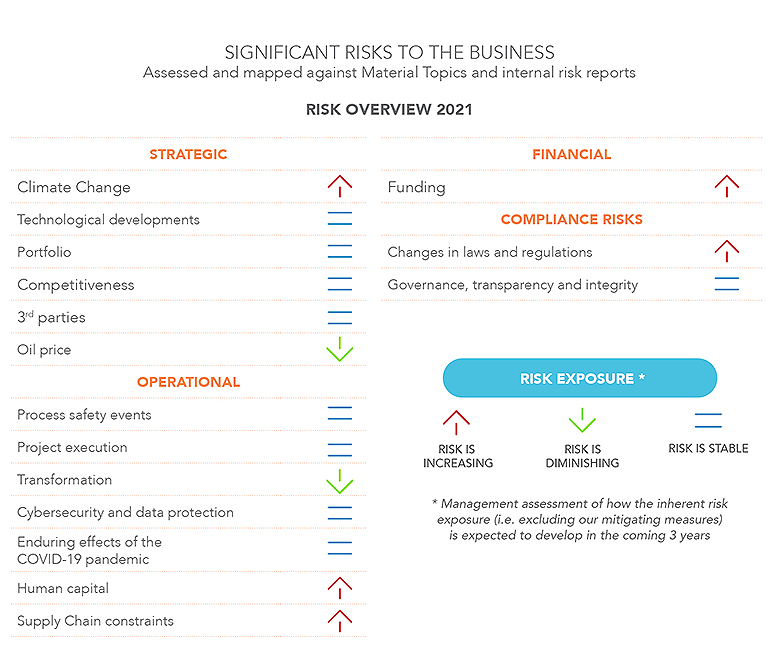

1.4.2Significant Risks to the Business

|

RISK |

DEFINITION |

RESPONSE MEASURES |

|---|---|---|

|

Strategic Risks |

||

|

Climate change |

SBM Offshore could face the impact of an accelerated energy transition driven by climate change. SBM Offshore may miss opportunities if it does not succeed i) in marketing competitive, sustainable technologies and/or (ii) enhancing the energy efficiency of its existing offerings. |

SBM Offshore continuously updates its offerings in light of the changing energy landscape. It is enhancing products from its New Energies & Services (NES) portfolio through investment in new technology. In addition, SBM Offshore is reducing the emissions of its existing units through emissionZERO®. |

|

Technological developments |

SBM Offshore is committed to pioneering new technologies, incl. digitalization and New Energies products, and maintaining a high level of technical expertise. Main risks include the possibility of deploying immature new technologies or implementing proven technologies incorrectly, potentially causing damage to SBM Offshore’s business results and reputation. |

SBM Offshore employs a rigorous Technology Readiness Level (TRL) assessment of new technologies, which are verified and controlled at several stages during the development phase before being adopted on projects. A strong technical assurance function ensures compliance with internal and external technical standards, regulations and guidelines. See section 2.1.9. |

|

Portfolio |

SBM Offshore has a concentration of fossil-fuel related business activities in Brazil and Guyana. SBM Offshore could thus have impact from changes in local legislative and business environments, potentially affecting SBM Offshore’s business results. |

SBM Offshore aims to achieve a more balanced portfolio by diversifying into new markets, with different products, such as in New Energies & Services (NES) and developing low emission products. SBM Offshore conducts thorough risk assessments before any new country entry and actively engages with its clients to monitor and mitigate the respective country-related regulatory, commercial and technical risks. See section 1.2.1. |

|

Competitiveness |

Some of SBM Offshore’s Product Lines are in − or could be facing − harsh market conditions. To win projects, SBM Offshore needs to remain competitive in terms of price (by reducing costs), schedule (by shortening the date to first oil) and quality (by providing best-in-class products). |

To drive better performance, delivered faster, SBM Offshore has taken various initiatives in relation to digitalization and standardization, which are the basis for SBM Offshore’s Fast4Ward® approach. See section 2.1. |

|

3rd parties |

SBM Offshore’s activities leverage financial, strategic and operational partners in order to build new business and execute projects. Partnerships which do not live up to SBM Offshore’s expectations may affect the performance of projects and overall ambitions of SBM Offshore. |

Through robust processes, executed by subject matter experts within the relevant functions of SBM Offshore, SBM Offshore aims to select appropriate parties to work with. Examples of functions involved are Supply Chain, Construction, Compliance and Human Rights. |

|

Oil price |

A limited headroom between the actual oil price and the breakeven oil price is an inherent risk for upcoming projects. These projects could be put under scrutiny as well as investments to achieve SBM Offshore’s emissionZERO® ambition. |

SBM Offshore aims to maintain double resiliency in the volatile market environment by focusing on offering clients cost competitive and low carbon footprint solutions. SBM Offshore is also actively diversifying the product portfolio, e.g. to have >2GW of Floating Offshore Wind (FOW) installed or under construction by 2030. See section 2.1.11. |

|

Operational Risks |

||

|

Process safety events |

Potential acute or chronic exposure to hazards during SBM Offshore’s product life cycle can trigger an impact on people, the environment or assets. This can have further impact on other risks identified (such as human capital, access to funding). |

SBM Offshore manages its HSSE-related risks under three streams: i) engagement through development of a positive and proactive culture of care and leadership; and ii) alignment of practices as defined by management systems (this is supported by assurance of competency); and iii) predictive maintenance and proactive management of asset integrity to ensure suitability of critical plant systems. SBM Offshore enables learning, whereby lessons learned in operational experience facilitate risk-based decision-making in the Win and Execute phase, bringing safer design options, predictive maintenance and a focus on safety and environmentally critical equipment and tasks. See section 2.1.2. |

|

Project execution |

Inherent project risks exist, owing to a combination of potential effects of the COVID-19 pandemic, geo-political, regulatory, technical and third-party risks. This could lead to a potentially negative impact on people, the environment, reputation, cost and schedule. |

Managing projects is part of SBM Offshore’s DNA. Proper business-case analysis, suitable project management capabilities and capacities, combined with SBM Offshore’s professional ways of working, processes and procedures mitigate project execution risk. Additional risk-mitigating measures are in place related to the knowledge and understanding of the countries in which project execution and delivery take place. See section 2.1.4. |

|

Transformation |

SBM Offshore needs to ensure that the benefits of its Fast4Ward®, emissionZERO® and Digitalization program are reaped. Failure to achieve the anticipated benefits could damage SBM Offshore’s competitiveness. |

Change management has been identified as a key success factor of the Fast4Ward®, emissionZERO® and Digitalization programs. Change management ambassadors have been appointed and are working closely with the business in the journey towards the new ways of working. |

|

Cybersecurity and data protection |

SBM Offshore relies on data, much of which is confidential and is stored and processed in electronic format. Intrusion into SBM Offshore’s data systems may affect onshore and offshore activities. Secondary risks include theft of cash, proprietary and/or confidential information, with potential loss of competitiveness and/or business interruption as a consequence. |

The evolving nature of cybersecurity threats, including personnel working from home as a result of COVID-19, requires ongoing attention. There is continuous improvement to reduce risks through investment in hardware, software, monitoring and awareness training. The ability of the IT architecture and associated processes and controls to withstand cyber-attacks and follow recognized standards is subject to 24/7 monitoring, independent testing and audits. |

|

Enduring effects of COVID-19 |

Continuation of the effects of COVID-19 could cause an impact on employees and their families, and on aspects of the project life-cycle and supply chain. Globally, this could cause disruption in the execution of projects and fleet operations. |

When the consequences of the COVID-19 were felt in 2020, SBM Offshore put in place a robust oversight framework which sought to mitigate the impact on SBM Offshore and its employees. In 2021, SBM Offshore has been optimizing measures based on experience from 2020 to focus on areas such as protecting employees from COVID-19, offshore job rotation and mental health. See section 2.1.5. |

|

Human capital |

SBM Offshore aims to source and retain the correct capacity and capabilities of its human resources to support existing and upcoming projects, as well as to maintain the operational fleet. Failure to attract, care for physical/mental health and retain staff, especially in light of COVID-19, could have an adverse impact on SBM Offshore’s operations and quality of execution of projects. |

SBM Offshore remains focused on the health and well-being of employees. To maintain capacity and capabilities, SBM Offshore has streamlined its operating model and engages in partnerships. A talent development program is in place to engage and retain key personnel, thereby ensuring a sustainable future. See section 2.1.5. |

|

Supply Chain constraints |

A ramp-up of the post-COVID economy puts increased pressure on SBM Offshore’s supply chain, resulting in increased demand, limited availability and eventually increased prices charged by SBM Offshore’s suppliers and vendors. |

Management of supply chain risks is a cross-functional activity, in order to build flexibility, redundancy and ultimately resilience. Through strategic sourcing programs, SBM Offshore aims to mitigate the exposure from supply-chain-related risks. See section 2.1.4.3. |

|

Financial Risks |

||

|

Funding |

Financial institutions are facing increasing scrutiny on their exposure to fossil fuel related projects. Access to debt and equity funding is essential to the execution of FPSO projects, and failure to obtain funding could hamper SBM Offshore’s growth and ultimately prevent it from taking on new Lease & Operate projects. Financial covenants may need to be met with SBM Offshore’s Revolving Credit Facility (RCF) lenders, as well as under certain project financing facilities. Failure to comply with the covenants may adversely affect SBM Offshore’s ability to finance its ongoing activities. |

SBM Offshore aims to maintain an optimal capital structure and actively monitors its short- and long-term liquidity position, including the RCF and cash in hand. SBM Offshore aims to have sufficient headroom in relation to the financial ratios agreed with RCF lenders. The covenants are monitored continuously, with a short- and a long-term time-horizon. Adequate access to debt and equity funding is secured through use of SBM Offshore’s existing liquidity, by selling equity to third-parties, the use of bridge loans and long-term project financing. Debt funding is sourced from multiple markets, such as international project finance banks, capital markets transactions and Export Credit Agencies. |

|

Compliance Risks |

||

|

Changes in laws and regulations |

Changes in tax- and regulatory frameworks, for example the implementation of the Global Anti-Base Erosion Proposal (GloBE) – Pillar 2, or laws that require certain levels of local content, may expose SBM Offshore to financial impact. If not properly identified and taken into account, these changes may result in fines, sanctions or penalties. |

SBM Offshore takes great care to carry out its activities in compliance with laws and regulations, including international protocols or conventions that apply to its specific segments of operation. SBM Offshore values public perception, good relationships with authorities and is committed to acting as a good corporate citizen. The monitoring of laws and regulations is carried out continuously with attention and substantive changes are escalated. The impact on the Company as a result of GloBE, if any, will only be known with sufficient accuracy when the OECD has released the commentary associated to the Model Rules and after the EU has reached an agreement on the Pillar 2 directive. The financial risk of change in laws and regulations is mitigated as much as possible in contracts. See section 3.7. |

|

Governance, transparency and integrity |

Fraud, bribery or corruption could severely harm SBM Offshore’s reputation and business results. Failure by employees or business partners to live up to SBM Offshore’s values could lead to SBM Offshore incurring financial penalties, reputational damage and other negative consequences. |

SBM Offshore’s Compliance Program provides policy, training, guidance and risk-based oversight and control of compliance, to ensure ethical decision-making. The use of digital tools supports the continuous development of SBM Offshore’s Compliance Program. SBM Offshore’s Core Values, Code of Conduct and Anti-Bribery and Corruption Policy provide guidance to employees and business partners on responsible business conduct in line with SBM Offshore’s principles, which are further reinforced by contractual obligations where applicable. See section 2.1.1. |