1.4.3Climate Change Risk & Opportunity

A key challenge, and an opportunity, for SBM Offshore is to make a real and meaningful contribution to the energy transition. SBM Offshore is aware of the time-pressure building for the world to achieve a responsible transition in which energy stays affordable to those in need, while mitigating climate change impacts from greenhouse gas emissions from more traditional forms of energy. SBM Offshore’s vision for safe, sustainable and affordable energy is founded upon the belief that it has a role to play in the physical and transitional challenges that climate change brings.

SBM Offshore commits to a strategy and actions compatible with its ambition to achieve net-zero by no later than 2050, including emissions in Scope 1, Scope 2 and Scope 3 – Downstream Leased Assets. SBM Offshore envisages to apply a science-based approach, using key frameworks such as below, or equivalent:

- Assess the impact on the business using frameworks from the Task Force on Climate-Related Financial Disclosures (TCFD).

- Set targets, using guidance from the Science Based Targets initiative.

- Measure performance, based on guidance from the Greenhouse Gas Protocol and the EU Taxonomy.

- Disclose performance, leveraging above standards to disclose in this Report and the CDP Benchmark.

Through the above, SBM Offshore contributes to a responsible energy transition, where the safety, affordability and sustainability of energy are balanced to benefit the world.

Climate Change Management and Adaptation is a key topic and discussed at Management Board level.This is the case for regular performance management meetings – where performance of New Energies and the emissionZERO® transformation program is reviewed. On a quarterly basis, progress on the UN SDGs is discussed, including climate-change-related company targets. Climate change risk and opportunities are also discussed as per the risk-management cycle described in section 3.6. Outcomes of these meetings are, for example, the risk appetite statement mentioned in section 1.4.1, the long-term goals described in section 2.2 and the climate change ambitions and scenarios described in this paragraph. These scenarios are part of an ongoing process to challenge perspectives on the future business environment, rather than predictions of outcomes. Above ambitions reflect current understanding of the business and are subject to further development in the future.

Climate change impact assessments are also undertaken for client projects, in close co-operation with project lenders and external consultants, and provide insight on the physical and transitional risks on these projects. Examples of the physical risk metrics used are the exposure to flooding in yards under different climate scenarios and the number of storms in offshore locations. Transitional risk metrics examine the exposure to oil & gas supply/demand changes under various scenarios and the potential impact of carbon pricing.

SBM Offshore applies these insights to its strategy development and actions as part of its Enterprise Risk Management process. The sections below cover the mitigation of significant risks relating to climate change and portfolio risk, as explained in section 1.4.2.

SBM Offshore’s Strategy and Climate Change

Taking part in the energy transition and decarbonization of business operations are key elements of SBM Offshore’s strategy. SBM Offshore sets targets accordingly − most notably Ambition 2030, explained in section 1.3, and specific targets under SDGs 7, 9 and 13, as per section 2.2.

Under the strategy pillar Optimize , SBM Offshore focuses its efforts towards Target Excellence over the lifecycle of its assets, including asset integrity and operational readiness in the various weather conditions these assets are designed for. Furthermore, SBM Offshore is working to optimize its disclosure under the TCFD framework.

The strategic pillar of Transform includes the emissionZERO® program, under which SBM Offshore addresses decarbonization of its solutions, hence contributing to reduction of greenhouse gases.

Finally, under its Innovate strategic pillar, SBM Offshore focuses on the energy transition, i.e. bringing lower and non-carbon energy production solutions to market, such as floating offshore wind, wave energy and hydrogen, as explained in section 2.1.10.

Future-Proofing: Climate Change Scenarios

SBM Offshore has adopted two climate change scenarios to future-proof current strategy and take appropriate action. The scenarios are based on the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC) data, as explained in section 5.1.4.

- A steady Climate Change Scenario with a positive impact on climate change, but which falls short of meeting the Paris Agreement goals.

- A bold Climate Action Scenario providing for strong commitment towards targets, as per the Paris Agreement.

A number of conclusions can be drawn from the two scenarios, based on indicators such as the energy mix, demand for oil, carbon pricing and weather-related indicators such as sea levels, floods, storms and heat waves.

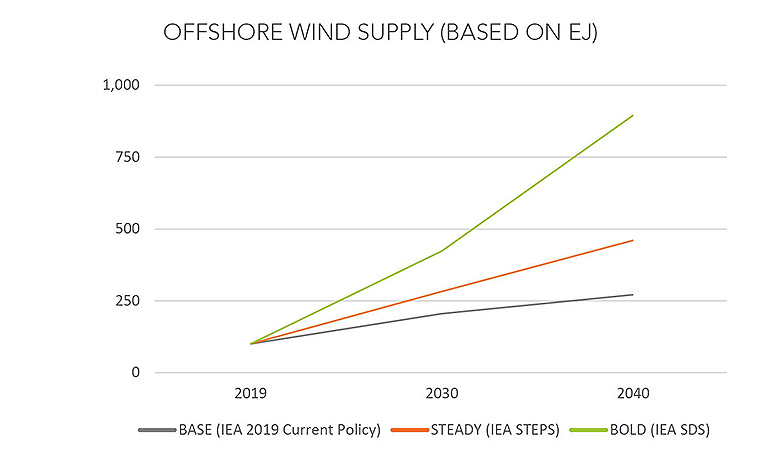

In a steady scenario, oil demand would keep growing until 2040 – beyond SBM Offshore’s assumptions in section 1.2 . In this scenario, there would be prolonged demand for oil- and gas-related floating energy production solutions. At the same time, the market for wind energy would more than triple between 2019 and 2040. The world would face a greater adverse physical impact from climate change. Global sea levels might rise between 44 and 101 cm by 2100, with rainfall extremes and the number of hot days increasing by 36% and 25% respectively. The physical risk for SBM Offshore is a disruption of onshore operations due to extreme weather events and climate patterns, either in its offices or at yard locations. Physical risks are less likely to impact offshore operations, as the units are equipped to withstand and/or avoid extreme weather events as was seen, for example, in the case of Turritella (FPSO) during the 2020 Atlantic hurricane season, where SBM Offshore helped its client Shell to ensure safe operations by leveraging disconnectable technology and associated procedures to activate these in order to mitigate extreme weather events. SBM Offshore mitigates risks via specific emergency response plans tailored to specific scenarios in each location and more generally, through the mitigation of process safety events and project execution risks, as explained in section 1.4.2. Response plans came into effect during the pandemic, and have proven their value, for example, extended rotation schedules for offshore workers, remote office working and dealing with potential disruption in construction activities. Physical impacts could provide opportunities for SBM Offshore – i.e. by providing floating energy production systems with high resiliency. This is supported by the climate change impact assessment undertaken for FPSO financing projects.

In the bold scenario, the energy mix would change more rapidly towards lower and non-carbon energy sources than is assumed today. The demand for wind energy would increase more than sevenfold between 2019 and 2040. This scenario assumes that peak oil will have happened at this stage, with oil supply decreasing by 34% between 2019 and 2040. According to the IEA, this scenario would require a carbon price for advanced economies of US$100 per tonne CO2 by 2030, leading to additional costs for SBM Offshore customers, adding to CAPEX and OPEX requirements and increasing the break-even prices of specific field developments. Given the relatively low break-even prices and low carbon intensity of the projects SBM Offshore is typically involved in, SBM Offshore expects its markets would suffer a relatively lower impact. This view is supported by the climate change impact assessment undertaken for FPSO projects. Physical risks in this scenario would still be present, but to a lesser extent than in the steady scenario.

Energy mix under steady and bold scenarios

(Index 2020 = 100)

Climate Change Risk, OpportunitY & Impact

Steady scenario

- Key risks in this scenario are: insufficient resources to keep up with demand in core markets; and lower new-market development owing to reduced need for diversification and the introduction of local carbon prices. Even if the demand for hydrocarbons grows, access to high-rated funding for these projects might become more challenging.

- Key opportunities in the steady scenario are: the need for resilient ocean energy solutions owing to increased weather events, a sustained demand for FPSOs and a larger opportunity for renewable energy solutions.

The bottom-line impact of the scenario is limited, namely a slight improvement in revenue potential through a stronger FPSO demand outlook and an opportunity for resilient energy production solutions and projects. Any contingency investments needed for weather-related CAPEX investments and operations disruption would need to be borne by project pricing, with potential disruptions being mitigated by force-majeure and emergency response plans. Also, in a steady scenario the growth of the renewable energy demand remains robust and supportive to the growth of SBM Offshore’s New Energies value platform.

Bold scenario

- Key risks in this scenario are: the decrease in demand and access to funding for FPSOs with a traditional emissions profile; insufficient internal resources to address the energy transition; and increasing carbon taxes.

- Key opportunities in the bold scenario are: the development of new ocean energy solutions that address the energy transition; increased customer demand for zero-emission oil & gas solutions; and the ability to attract new investors supporting SBM Offshore’s sustainability agenda. An increased carbon price would also lead to a more favorable business case for renewable energy and emissionZERO® products.

The bottom-line impact of the scenario on demand for SBM Offshore’s traditional markets could be significant if unmitigated and, as such, it is covered by scenario planning under SBM Offshore’s Group Strategy Development and Performance Management approach. In particular, the Growing the Core value platform is important in this respect, as it aims for ’double-resiliency’, with:

- emissionZERO® ensuring a lower carbon footprint of SBM Offshore’s products and

- Fast4Ward® increasing the affordability of SBM Offshore’s solutions.

For the New Energies value platform, a bold scenario would mean an increased market size and opportunity for higher revenues. This would require further growth of CAPEX & OPEX into EU Taxonomy-eligible activities, as described in section 5.1.5.

|

SBM Offshore Strategy and additional measures explored per climate change scenario |

||

|

SBM Offshore Strategy |

Steady scenario |

Bold scenario |

|---|---|---|

|

A strategy and action plan that is compatible with the transition to net-zero by no later than 2050, including: |

Key impact: Slight improvement in FPSO demand outlook; opportunity for resilient energy production solutions and projects. Additional potential response by SBM Offshore versus current strategy: |

Key impact: Decline of demand for traditional products; leading to declines in revenue potential. Demand for renewable energy projects brings further significant revenue potential. Additional potential response by SBM Offshore versus current strategy: |

|

|

|