3.4.2Execution of the Management Board Remuneration Policy in 2021

The Supervisory Board is responsible for ensuring that the remuneration policy is appropriately applied and aligned with the Company’s objectives. The remuneration level is determined by the Supervisory Board using a comparison with Dutch and international peer companies, as well as internal pay ratios across the Company.

Reference Group

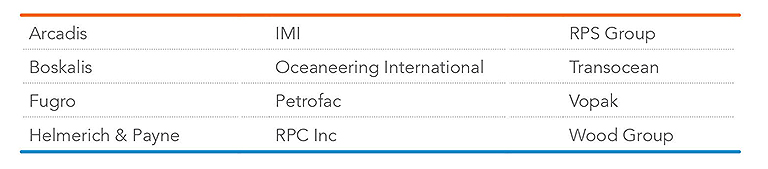

In order to determine a competitive Base Salary level and to monitor total remuneration levels of the Management Board, a reference group of relevant companies in the industry (the ‘Reference Group‘) has been defined. Pay levels of the Management Board members are benchmarked annually to the Reference Group. In the event a position cannot be benchmarked within the Reference Group, the Supervisory Board may benchmark a position to similar companies. In 2021, the Reference Group consisted of:1

Also in 2021, the Supervisory Board assessed the Management Board’s remuneration in relation to the Reference Group’s pay levels, revenue and market capitalization, mostly as part of the preparation of implementing RP 2022.

The final determination of pay levels for the Management Board also took into account various scenario analyses to assess the impact of different performance levels and share price developments on the total remuneration paid.

Pay ratio

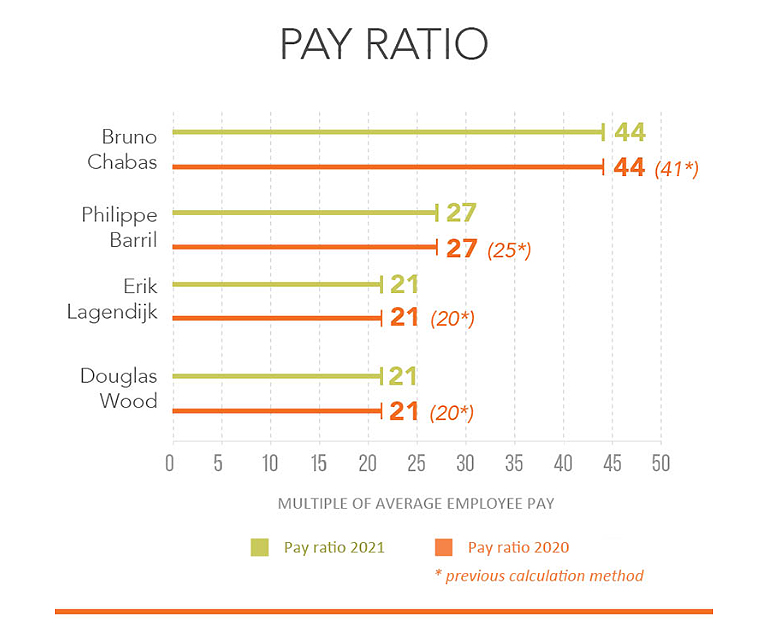

The Supervisory Board also includes internal pay ratios when assessing Management Board pay levels.2 Per 2021 , the Monitoring Committee of the Dutch Corporate Governance Code has set guidelines regarding the calculation of the internal pay ratio. In line with the guidelines, SBM Offshore has changed the calculation on two items: (i) contractors with an employment for at least 3 months are now included in the calculation and (ii) the average employee costs are calculated based on FTE rather than headcount. The average total employee and contractor costs per FTE in 2021 was EUR103 thousand.

The pay-ratio’s of each of the Management Board members over 2021 and 2020 are displayed in the following graph (whereas also for 2020 the new calculation method was applied).

Total Remuneration overview

The table below provides you with insight in the costs for SBM Offshore for Management Board reward in 2021 (based on RP 2018). The table below presents an overview of the remuneration of the Management Board members who were in office in 2021.

|

Bruno Chabas |

Philippe Barril |

Erik Lagendijk |

Douglas Wood |

Total |

||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

in thousands of EUR |

2021 |

2020 |

2021 |

2020 |

2021 |

2020 |

2021 |

2020 |

2021 |

2020 |

|

Base salary |

960 |

960 |

634 |

634 |

518 |

518 |

518 |

518 |

2,630 |

2,630 |

|

STI |

1,279 |

1,176 |

633 |

582 |

517 |

475 |

517 |

475 |

2,946 |

2,708 |

|

Value Creation Stake |

1,797 |

1,965 |

1,186 |

1,311 |

968 |

1,062 |

968 |

1,071 |

4,919 |

5,408 |

|

Pensions |

294 |

296 |

158 |

158 |

129 |

129 |

129 |

129 |

710 |

712 |

|

Other |

250 |

213 |

188 |

154 |

45 |

39 |

50 |

44 |

533 |

450 |

|

Total expense for remuneration |

4,580 |

4,610 |

2,799 |

2,839 |

2,177 |

2,223 |

2,182 |

2,237 |

11,738 |

11,908 |

|

in thousands of US$ |

5,416 |

5,265 |

3,310 |

3,243 |

2,575 |

2,539 |

2,581 |

2,555 |

13,883 |

13,601 |

1. Base Salary

The 2021 and 2020 Base Salary levels of the Management Board members are shown both in the table at the beginning of section: Management Board Remuneration in 2021 and in the table Remuneration of the Management Board by member in section 3.4.3.

2. Short-Term Incentive

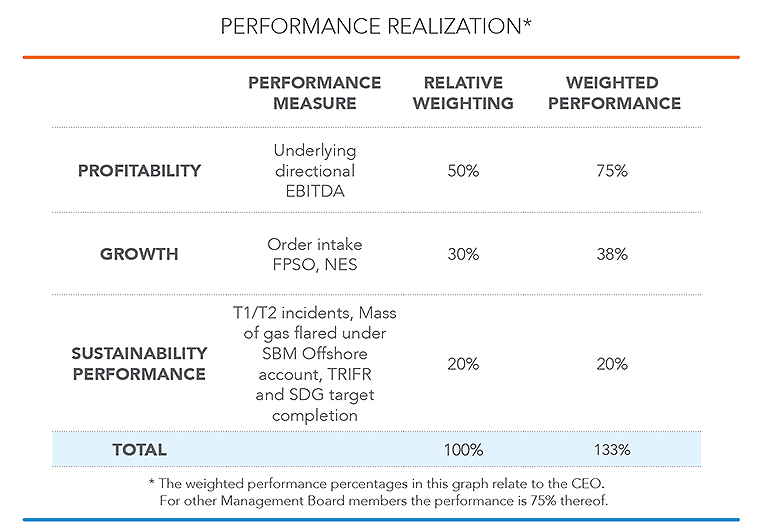

For 2021, the Supervisory Board set the following performance measures and corresponding weighting, which led to the following performance realization. For full details regarding the performance under the STI, please refer to the Performance STI 2021 table in section 3.4.3.

Profitability performance reached the maximum threshold of 150% with an underlying directional EBITDA of US$931 million against target level of US$920 million. Growth performance, measured as order intake FPSO and NES resulted in a performance of 125% which is between target and maximum. Sustainability performance performed slightly above target at 104%. The overall weighted performance of the CEO is 133% and for the other Management Board members the performance is 75% thereof (100%).

3. Value Creation Stake

The Supervisory Board decided to grant the Value Creation Stake for 2021 to the Management Board members in accordance with RP 2018. The underpin test as explained in section 3.4.1 was applied to this grant. As per RP 2018, the granted Value Creation Stake vests immediately. The gross annual value for each of the Management Board members is 175% of Base Salary. The number of shares was based on the four year average share price (volume weighted) at the date of the respective grant. The cost of the granted Value Creation Stake is included in the table at the beginning of this section 3.4.2. The number of shares vested under the Value Creation Stake can be found in section 3.4.3 of this remuneration report under Conditions of and information regarding share plans.

The actual shareholdings of the Management Board members per the end of 2021, in which only conditional shares are taken into account, can be found at the end of the Overview Share-Based Incentives (section 3.4.3). This overview also includes the number of conditionally granted and/or vested shares in the last few years.

4. Shareholding requirement Management Board

The following table contains an overview of shares held in SBM Offshore N.V. by members of the Management Board per December 31, 2021.

|

Shares subject to conditional holding requirement |

Other shares |

Total shares at 31 December 2021 |

Total shares at 31 December 2020 |

|

|---|---|---|---|---|

|

Bruno Chabas |

366,605 |

824,465 |

1,191,070 |

1,127,604 |

|

Philippe Barril |

263,184 |

54,778 |

317,962 |

387,826 |

|

Erik Lagendijk |

179,081 |

77,549 |

256,630 |

222,418 |

|

Douglas Wood |

181,460 |

46,856 |

228,316 |

194,104 |

|

990,330 |

1,003,648 |

1,993,978 |

1,931,952 |

All Management Board members met the share ownership requirement, which is set at an equivalent of 350% of their Base Salary. Section 3.4.3 contains more information about the (historical) share plans for the Management Board.

5. Pensions and benefits

Management Board members received a pension allowance equal to 25% of their Base Salary. In case these payments are not made to a qualifying pension fund, Management Board members are individually responsible for the contribution received and SBM Offshore withholds wage tax on these amounts. For the CEO, two pension arrangements (defined contribution) are in place and its costs are included in the table at the beginning of this section 3.4.2.

The Management Board members received several allowances in 2021, including a car allowance and a housing allowance (Bruno Chabas and Philippe Barril). The value of these elements is included in the table at the beginning of this section 3.4.2 and in section 3.4.3.