4.6.3Independent Auditor’s Report

To: the general meeting and the Supervisory Board of SBM Offshore N.V.

|

Report on the financial statements 2021 |

|---|

|

|

|

In our opinion:

|

|

What we have audited |

|

We have audited the accompanying financial statements 2021 of SBM Offshore N.V., Amsterdam as included in sections 4.2 up to and including 4.5. The financial statements include the consolidated financial statements of the Group and the company financial statements. |

|

The consolidated financial statements comprise:

|

|

The Company financial statements comprise:

|

|

The financial reporting framework applied in the preparation of the financial statements is EU-IFRS and the relevant provisions of Part 9 of Book 2 of the Dutch Civil Code for the consolidated financial statements and Part 9 of Book 2 of the Dutch Civil Code for the Company financial statements. |

|

The basis for our opinion |

|

We conducted our audit in accordance with Dutch law, including the Dutch Standards on Auditing. We have further described our responsibilities under those standards in the section ‘Our responsibilities for the audit of the financial statements’ of our report. |

|

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. |

|

|

|

We are independent of SBM Offshore N.V. in accordance with the European Union Regulation on specific requirements regarding statutory audit of public-interest entities, the ‘Wet toezicht accountantsorganisaties’ (Wta, Audit firms supervision act), the ‘Verordening inzake de onafhankelijkheid van accountants bij assuranceopdrachten’ (ViO, Code of Ethics for Professional Accountants, a regulation with respect to independence) and other relevant independence regulations in the Netherlands. Furthermore, we have complied with the ‘Verordening gedrags- en beroepsregels accountants’ (VGBA, Dutch Code of Ethics). |

|

Our audit approach |

|

Overview and context |

|

We designed our audit procedures in the context of our audit of the financial statements as a whole. Our comments and observations regarding individual key audit matters, our audit approach regarding fraud risks and our audit approach regarding going concern should be read in this context and not as a separate opinion or conclusion on these matters. |

|

SBM Offshore N.V serves the offshore oil and gas industry by supplying engineered products, vessels and systems, as well as offshore oil and gas production services. This includes the construction and the leasing and operating of large and complex offshore floating production, storage and offloading vessels (FPSOs). The Group is comprised of several components and, therefore, we considered our group audit scope and approach as set out in the section ‘The scope of our group audit’. We paid specific attention to the areas of focus driven by the operations of the Group, as set out below. |

|

As part of designing our audit, we determined materiality and assessed the risks of material misstatement in the financial statements. In particular, we considered where the management board made important judgements, for example, in respect of significant accounting estimates that involved making assumptions and considering future events that are inherently uncertain. In these considerations, we paid attention to, amongst others, the assumptions underlying the physical and transition impacts of climate-related risks. |

|

In paragraph 4.2.7 of the financial statements, the Company describes the areas of judgement in applying accounting policies and the key sources of estimation uncertainty. We identified complex lease accounting as a key audit matter because the accounting treatment of lease transactions during the year was considered to be complex and judgemental as set out in the section ‘Key audit matters’ of this report. Furthermore, given the significant estimation uncertainty and the related higher inherent risks of material misstatement in construction contracts, we considered this as key audit matter as well. |

|

SBM Offshore N.V. assessed the possible effects of climate change and its plans to meet the emissionZERO® commitments on its financial position. In paragraph 1.4.3 of the annual report and 4.3.28 of the consolidated financial statements, the Management Board reflects on climate-related risk and opportunities. We discussed management’s assessment and governance thereof and evaluated the potential impact on the financial position including underlying assumptions and estimates. Management concluded that the climate change has no impact on the carrying amounts of assets and liabilities as of December 31, 2021. It is management’s assessment that the future estimates and judgements underlying the carrying amounts of assets or liabilities will be influenced by its response to and assessment of climate related risks. During the audit we involved our sustainability specialists to assess the climate related risks. The impact of climate change is not considered to impact our key audit matters. |

|

Other areas of focus, that were not considered to be key audit matters, were the lease classification of awarded contracts, valuation of finance lease receivables, segment reporting disclosure and accounting for uncertain tax positions. There were also internal control matters identified relating to the IT environment that required additional audit effort but these were not considered key audit matters. |

|

We ensured that the audit teams both at group and at component level included the appropriate skills and competences that are needed for the audit of a Company providing floating production solutions to the offshore energy industry over the full product lifecycle. We included members with relevant industry-expertise and specialists in the areas of IT, corporate income tax, valuation, sustainability and employee benefits in our audit team. We also involved forensics specialists in our assessment of fraud risk factors. |

|

The outline of our audit approach was as follows: |

|

|

|

|

|

Audit scope |

|

|

|

|

Key audit matters |

|

|

|

Materiality |

|

The scope of our audit was influenced by the application of materiality, which is further explained in the section ‘Our responsibilities for the audit of the financial statements’. |

|

Based on our professional judgement we determined certain quantitative thresholds for materiality, including the overall materiality for the financial statements as a whole as set out in the table below. These, together with qualitative considerations, helped us to determine the nature, timing and extent of our audit procedures on the individual financial statement line items and disclosures and to evaluate the effect of identified misstatements, both individually and in aggregate, on the financial statements as a whole and on our opinion. |

|

Overall group materiality |

US$27 million (2020: US$22 million). |

|

Basis for determining materiality |

We used our professional judgement to determine overall materiality. As a basis for our judgement, we used 5% of profit before income tax. |

|

Rationale for benchmark applied |

We used this benchmark and the rule of thumb (%), based on our analysis of the common information needs of users of the financial statements, including factors such as the headroom on covenants and the financial position of the Group. On this basis, we believe that profit before income tax is an important metric for the financial performance of the Group. |

|

Component materiality |

To each component in our audit scope, we, based on our judgement, allocated materiality that is less than our overall group materiality. The range of materiality allocated across components was between US$15 million and US$20 million. |

|

We also take misstatements and/or possible misstatements into account that, in our judgement, are material for qualitative reasons. |

|

|

We agreed with the Supervisory Board that we would report to them any misstatement identified during our audit above US$10 million (2020: US$10 million) for balance sheet reclassifications and US$2.2 million for profit before tax impact (2020: US$2.2 million) as well as misstatements below that amount that, in our view, warranted reporting for qualitative reasons. |

|

|

The scope of our group audit |

|

|

SBM Offshore N.V. is the parent company of a group of entities. The financial information of this group is included in the consolidated financial statements of SBM Offshore N.V. |

|

|

We tailored the scope of our audit to ensure that we, in aggregate, provide sufficient coverage of the financial statements for us to be able to give an opinion on the financial statements as a whole, taking into account the management structure of the Group, the nature of operations of its components, the accounting processes and controls, and the markets in which the components of the Group operate. In establishing the overall group audit strategy and plan, we determined the type of work required to be performed at component level by the group engagement team and by each component auditor. |

|

|

The group audit focused on two components in Monaco (Turnkey as well as Operations), the treasury shared service center in Marly, Switzerland and one other component (Group Corporate Departments) located in Amsterdam, the Netherlands. The Turnkey as well as Operations components in Monaco were subject to audits of their financial information as those components are individually significant to the Group. |

|

|

The processes and financial statement line items managed by the treasury shared service center in Marly, Switzerland, were subject to specified audit procedures. For the Group Corporate Departments component in Amsterdam, the group engagement team performed audit work on specified balances to achieve appropriate coverage on financial line items in the consolidated financial statements. |

|

|

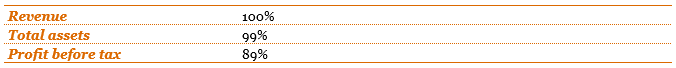

In total, in performing these procedures, we achieved the following coverage on the financial line items:

|

|

None of the remaining components represented more than 1% of total group revenue or total group assets. For those remaining components we performed, among other things, analytical procedures to corroborate our assessment that there were no significant risks of material misstatements within those components. |

|

For the components in Monaco and the treasury shared service center in Marly, Switzerland, we used component auditors who are familiar with the local laws and regulations to perform the audit work. The audit was largely performed remotely as a result of COVID-19, however for key meetings and audit procedures both the group and component engagement teams visited the client offices. For remote audit procedures we used video conferencing and digital sharing of screens and documents. |

|

Where component auditors performed the work, we determined the level of involvement we needed to have in their work to be able to conclude whether we had obtained sufficient and appropriate audit evidence as a basis for our opinion on the consolidated financial statements as a whole. |

|

We issued instructions to the component audit teams in our audit scope. These instructions included amongst others our risk analysis, materiality and the scope of the work. We explained to the component audit teams the structure of the Group, the main developments that were relevant for the component auditors, the risks identified, the materiality levels to be applied and our global audit approach. We had individual calls with each of the in-scope component audit teams both during the year and upon conclusion of their work. During these calls, we discussed the significant accounting and audit issues identified by the component auditors, their reports, the findings of their procedures and other matters, that could be of relevance for the consolidated financial statements. |

|

In 2021, the group audit team held virtual meetings instead of physical visits due to COVID-19 related travel restrictions. For these virtual meetings more time was taken, and sufficient involvement was achieved. The group audit team met with both the Turnkey as well as Operations components in Monaco given the importance of these components to the consolidated financial statements as a whole and the judgements involved in the estimates in construction contracts (refer to the respective key audit matter). For the components in Monaco and the treasury shared service center in Marly, Switzerland, we remotely reviewed selected working papers of the respective component auditors. |

|

In addition to the work on the Group Corporate Departments component, the group engagement team performed the audit work on the group consolidation, financial statement disclosures and a number of complex accounting matters at the head office. These included impairment assessments, accounting implication assessments of lease extensions and modifications as well as business combinations, share-based payments, taxes including deferred taxes and uncertain tax provisions and directional reporting as part of the segment reporting disclosures. |

|

By performing the procedures outlined above at the components, combined with additional procedures exercised at group level, we have been able to obtain sufficient and appropriate audit evidence on the Group’s financial information, as a whole, to provide a basis for our opinion on the financial statements. |

|

|

|

We identified and assessed the risks of material misstatements of the financial statements due to fraud. During our audit we obtained an understanding of the Company and its environment and the components of the system of internal control, including the risk assessment process and management’s process for responding to the risks of fraud and monitoring the system of internal control and how the supervisory board exercises oversight, as well as the outcomes. We refer to section 1.4, 2.1.1 and 3.6 of the annual report where the Management Board reflects on its response to fraud risk. |

|

We evaluated the design and relevant aspects of the system of internal control and in particular the fraud risk assessment, as well as among others the code of conduct, whistle blower procedures and incident registration. We evaluated the design and the implementation and, where considered appropriate, tested the operating effectiveness, of internal controls designed to mitigate fraud risks. |

|

As part of our process of identifying fraud risks, we, in co-operation with our forensic specialists, evaluated fraud risk factors with respect to financial reporting fraud, misappropriation of assets and bribery and corruption. We evaluated whether these factors indicate that a risk of material misstatement due to fraud is present. |

|

We identified the following fraud risks and performed the following specific procedures: |

|

Identified fraud risks |

Our audit work and observations |

|---|---|

|

Management override of controls |

|

|

In all our audits we pay attention to the risk of management override of controls, including the risk of potential misstatements as a result of fraud based on an analysis of interests of management. In this context we paid specific attention to this risk at the transaction level of revenue and construction contracts given the estimates and judgements involved. We paid attention to the impact of COVID-19 on the effectiveness of internal controls.

|

Where relevant to our audit, we evaluated the design of the internal control measures that are intended to mitigate the risk of management override of controls and assessed the effectiveness of the measures in the processes generating journal entries, making estimates, and monitoring projects. We also paid specific attention to the access safeguards in the IT system and the possibility that these lead to violations of the segregation of duties. Due to COVID-19 we performed specific testing around the effectiveness of internal control measures, as well as having multiple discussions with management around potentially impacted areas. We concluded that we, in the context of our audit, could rely on the internal control procedures relevant to this risk. We performed journal entry testing procedures on the following criteria: unexpected account combinations, unusual words and unexpected users. With respect to journal entries, we also tested transactions outside of the ordinary course of business where applicable. In addition, we also tested manual consolidation adjustments. With regard to management’s accounting estimates, we evaluated key estimates and judgements for bias, including retrospective reviews of prior year’s estimates. We performed substantive audit procedures for the estimates in revenue and construction contracts. Our audit procedures did not lead to specific indications of fraud or suspicions of fraud with respect to management override of internal controls. |

|

Risk of fraud in revenue recognition – construction contracts |

|

|

Given the listed status of SBM Offshore N.V., the significant shareholdings of management in SBM Offshore N.V. as a result of share-based payment plans and financial targets for management, the complex nature of the Company’s construction contracts and the significant judgements and estimates, the revenue recognition of construction contracts was particularly subject to the risk of a material misstatement due to fraud. The determination of the turnkey result based on over time recognition is an exercise requiring significant judgement and management could use this estimate in order to manipulate the figures to shift results to upcoming year(s). Due to this, we deem the risk significant for the cut-off assertion for revenue. |

Where relevant to our audit, we assessed the design of the internal control measures and the effectiveness of these measures in the processes for recording costs and revenues relating to construction contracts. This includes project forecasting, measurement of the progress towards complete satisfaction of the performance obligation to determine the timing of revenue recognition and the Company’s internal project reviews. We concluded that we, in the context of our audit, could rely on the internal control procedures relevant to this risk. With respect to the satisfaction of the performance obligations over time and the cut-off for individual projects under construction we examined, discussed, and challenged project documentation on the status, progress and forecasts with those charged with governance, management, finance and technical staff of the Company. We evaluated and substantiated the outcome of these discussions by examining modifications of contracts such as claims and variation orders between the Company, subcontractors and clients and responses thereto. In addition, we performed substantive procedures such as a detailed evaluation of forecasts and ongoing assessment of management’s judgement on issues, evaluation of budget variances and obtaining corroborating evidence, evaluation of project contingencies and milestones and recalculation of the progress towards complete satisfaction of the performance obligation. In addition, we evaluated indications of possible management bias. We performed look-back procedures as part of our risk assessment procedures by comparing the estimates included in the current projects with past projects of similar nature as this provides insight in the ability of management to provide reliable estimates. Based on the look-back procedures we did not identify any additional risks. In addition, at the end of the year, we conducted specific substantive audit procedures regarding the cut-off of construction contracts to determine that there were no shifts in results per individual project and/or between the current and next financial year. Finally, we selected journal entries based on specific risk criteria and performed substantive audit procedures during which we also paid attention to significant transactions outside the normal course of business. Our audit procedures did not identify any material misstatements in the information provided by management in the financial statements and the management report compared with the financial statements. Our audit procedures did not lead to specific indications of fraud or suspicions of fraud with respect to management override of internal controls. |

|

Risk of fraud in revenue recognition – lease and operate |

|

|

Although the lease contracts and many of the operate contracts itself specify specific day-rates per vessel and periodic operating fees (and therefore the revenue is very predictable and relatively certain) there are elements in which management could manipulate the lease and operate revenue, such as the recognition of maluses. We consider accuracy, existence and occurrence as assertions relevant for the risk of fraud in revenue recognition for lease & operate revenues. |

Where relevant to our audit, we assessed the design of the internal control measures and the effectiveness of these measures in the processes for recording costs and revenues relating to the lease and operate contracts. This includes gaining an understanding of the underlying contracts, malus arrangements and key performance indicators like up- and downtime to determine the possible impact on the revenue recognition. We concluded that we, in the context of our audit, could rely on the internal control procedures relevant to this risk. With respect to the satisfaction of the performance obligations for individual contracts, we examined, discussed, and challenged SBM Offshore N.V. on the recognition of maluses with management, finance, and technical staff of the Company. We evaluated and substantiated the outcome of these discussions by examining recognized claims and maluses by the Company and responses thereto, performing substantive procedures such as obtaining corroborating evidence, evaluation of vessels report. In addition, as part of our substantive audit procedures we evaluated indications of possible management bias. Finally, we selected journal entries based on specific risk criteria and performed substantive audit procedures in which we also paid attention to significant transactions outside the normal course of business. Our audit procedures did not identify any material misstatement in the information provided by management in the financial statements and the management report compared with the financial statements. Our audit procedures did not lead to specific indications of fraud or suspicions of fraud with respect to management override of internal controls. |

|

Risk of bribery and corruption |

|

|

The company operates in countries with a higher risk of corruption based on the Corruption Perception Index of Transparency International. For this reason, we paid particular attention to the risk of the payment of bribes by and at the initiative of agents in transactions concluded using agents. |

Where relevant to our audit, we assessed the design and effectiveness of the internal control measures with respect to contracts with clients and agents and the review of the work by agents. We concluded that we, in the context of our audit, could rely on the internal control procedures relevant to this risk. We held various meetings with management and other SBM Offshore N.V. staff to discuss the risk of bribery and corruption. Amongst others we spoke to the group compliance and legal director, internal audit director, CFO, CGCO and CEO. We assessed that no new contracts with agents have been agreed in 2021. Amongst others we performed the following procedures:

Finally, we selected journal entries based on specific risk criteria and performed substantive audit procedures in which we also paid attention to significant transactions outside the normal course of business. Our audit procedures did not identify any material misstatement in the information provided by management in the financial statements and the management report compared with the financial statements. Our audit procedures did not lead to specific indications of fraud or suspicions of fraud with respect to the risk of bribery and corruption. |

|

We incorporated elements of unpredictability in our audit. We also considered the outcome of our other audit procedures and evaluated whether any findings were indicative of fraud or noncompliance. |

|

|

|

Management prepared the financial statements based on the assumption that the Company is a going concern and that it will continue its operations for the foreseeable future. Refer to paragraph 4.3.28 in the financial statements. |

|

Our procedures to evaluate management’s going concern assessment include, amongst others:

|

|

Our procedures did not result in outcomes contrary to management’s assumptions and judgments used in the application of the going concern assumption. |

|

|

|

Key audit matters are those matters that, in our professional judgement, were of most significance in the audit of the financial statements. We communicated the key audit matters to the Supervisory Board. The key audit matters are not a comprehensive reflection of all matters identified by our audit and that we discussed. In this section, we described the key audit matters and included a summary of the audit procedures we performed on those matters. |

|

We addressed the key audit matters in the context of our audit of the financial statements as a whole, and in forming our opinion thereon. We do not provide separate opinions on these matters or on specific elements of the financial statements. Any comment or observation we made on the results of our procedures should be read in this context. |

|

As part of designing our audit, we determined materiality and assessed the risks of material misstatement in the financial statements. In particular, we considered where the Management Board made important judgements. We also considered significant accounting estimates that involved making assumptions and consideration of future events that are inherently uncertain. In paragraph 4.2.7 subsection ‘Use of estimates and judgement’ of the financial statements, the Group describes the areas of judgement in applying accounting policies and the key sources of estimation uncertainty. |

|

The Group entered into contracts that had a significant impact on its statement of financial position and income statement from a lease accounting perspective which therefore requires judgment from management. We therefore consider ‘Complex lease accounting’ to be a key audit matter. In addition, as a result of the magnitude of the current projects undertaken by the Group and the inherent estimation uncertainty we continue to consider ‘Estimates and judgements in construction contracts’ to be a key audit matter as well. |

|

Key audit matter |

Our audit work and observations |

|---|---|

|

Complex lease accounting |

|

|

Note 4.2.7, 4.3.2, and 4.3.3 to the consolidated financial statements |

|

|

The Company entered into 3 new significant contracts for FPSO’s. The accounting for of these contracts with customers under IFRS 16 ‘Leases’ requires a detailed analysis and are dependent on the specific arrangements between the Group and its clients as agreed upon in the contracts. The guidance provided by IFRS 16 however, is mainly from a lessee perspective, and provides less guidance from a lessor perspective, which is the majority of the Groups portfolio. In case of contract extensions or modifications the implications of these on the (lessor) lease accounting requires significant management judgement, to a large extent due to the absence of detailed lessor guidance. In 2021 transactions took place where lease accounting played an important role. The lease extension on FPSO Kikeh and as mentioned the 3 new awarded FPSO contracts. We considered this area to be a key audit matter given the magnitude of the amounts involved, the complex nature of these transactions and the significant judgements in the application of lease accounting from a lessor perspective. |

For every FPSO contract awarded, management prepares an accounting paper on how to account for it. We evaluate these papers and read the relevant contracts. Based on our reading of the contracts, we considered whether the judgements made by management on the accounting treatment were appropriate. This includes the corresponding identification of performance obligations, including whether they are distinct. Furthermore, we assessed whether the satisfaction of the performance obligations to be recognized as revenue recognition should be as either point in time or over time. We focused our work on assessing whether the accounting treatment is in line with IFRS with support of our lease accounting specialists. In 2021 the Company signed a 6 year extension for FPSO Kikeh located in Malaysia. We evaluated the contract terms and agree with the accounting of the extension as a lease modification. Our audit procedures did not indicate material findings with respect to the estimates and judgements made in the interpretation and accounting for these contract changes and modifications. |

|

Estimates and judgements in construction contracts |

|

|

Note 4.2.7, 4.3.3 and 4.3.20 to the consolidated financial statements |

|

|

The accounting for contracts with customers under IFRS 15 ‘Revenue from contracts with customers’ is complex and dependent on the specific arrangements between the Group and its clients as agreed upon in the contracts. Given the unique nature of each separate project and contract, management performed a contract analysis on a case-by-case basis to determine the applicable accounting and revenue recognition. Significant management judgement is applied in identifying the performance obligations and determining whether they are distinct, the method of revenue recognition as either point in time or over time, contract modifications and variable consideration, since these areas are complex and subjective. Based on our risk assessment the most critical and judgmental estimates to determine satisfaction of the performance obligations over time is the estimate of the cost to complete and the measurement of progress towards complete satisfaction of the performance obligation, including the subjectivity and estimation uncertainty in the assessment of remaining risks and contingencies that a project is or could be facing. In 2021 the Company continued to face COVID-19 and operational challenges. These include travel and logistical restrictions, price inflation of materials and services, yard closures and yard and supplier capacity constraints. The degree to which these challenges influenced the cost to complete varied from project to project and can be significant. Given the magnitude of the amounts involved (US$ 2,477 million of turnkey revenue and US$4,140 million of construction work-in-progress), the complex nature of the Group’s construction contracts and the significant judgements and estimates, these areas were particularly subject to the risk of misstatement related to either error or fraud. Based on the above considerations we considered this area to be a key audit matter. |

We assessed whether the satisfaction of the performance obligations to be recognized as revenue recognition should be as either point in time or over time. We performed look-back procedures as part of our risk assessment procedures by comparing the estimates included in the current projects with past projects of similar nature as this provides insight in the ability of management to provide reliable estimates. Based on the look-back procedures we did not identify any additional risks. We gained an understanding of processes, evaluated and tested the relevant controls the Group designed and implemented within its process to record costs and revenues relating to construction contracts. This includes project forecasting, measurement of the progress towards complete satisfaction of the performance obligation to determine the timing of revenue recognition and the Group’s internal project reviews. We found the controls to be designed, implemented and operating effectively for the purpose of our audit. With respect to the satisfaction of the performance obligations over time we examined project documentation on the status, progress and forecasts of projects under construction and discussed and challenged those with management, finance and technical staff of the Group. We evaluated and substantiated the outcome of these discussions by examining modifications of contracts such as claims and variation orders between the Group, subcontractors and clients and responses thereto. In addition, we performed procedures such as a detailed evaluation of forecasts and ongoing assessment of management’s judgement on issues, evaluation of budget variances and obtaining corroborating evidence, evaluation of project contingencies and milestones and recalculation of the progress towards complete satisfaction of the performance obligation. In addition, we evaluated indications of possible management bias. Our audit procedures did not indicate material findings with respect to the estimates and judgements in construction contracts. |

|

Report on the other information included in the annual report |

|---|

|

The annual report contains other information. This includes all information in the annual report in addition to the financial statements and our auditor’s report thereon. |

|

Based on the procedures performed as set out below, we conclude that the other information:

|

|

We have read the other information. Based on our knowledge and the understanding obtained in our audit of the financial statements or otherwise, we have considered whether the other information contains material misstatements. |

|

By performing our procedures, we comply with the requirements of Part 9 of Book 2 and section 2:135b subsection 7 of the Dutch Civil Code and the Dutch Standard 720. The scope of such procedures was substantially less than the scope of those procedures performed in our audit of the financial statements. |

|

The management board is responsible for the preparation of the other information, including the directors’ report and the other information in accordance with Part 9 of Book 2 of the Dutch Civil Code. The management board and the supervisory board are responsible for ensuring that the remuneration report is drawn up and published in accordance with sections 2:135b and 2:145 subsection 2 of the Dutch Civil Code. |

|

Report on other legal and regulatory requirements and ESEF |

|---|

|

Our appointment |

|

We were nominated as auditors of SBM Offshore N.V. on 13 November 2013 by the Supervisory Board and appointed through the passing of a resolution by the shareholders at the annual meeting held on 17 April 2014. Our appointment has been renewed on 7 April 2021 for a period of three years by the shareholders. Our appointment represents a total period of uninterrupted engagement of eight years. |

|

European Single Electronic Format (ESEF) |

|

SBM Offshore N.V. has prepared the annual report, including the financial statements, in ESEF. The requirements for this format are set out in the Commission Delegated Regulation (EU) 2019/815 with regard to regulatory technical standards on the specification of a single electronic reporting format (these requirements are hereinafter referred to as: the RTS on ESEF). In our opinion, the annual report prepared in XHTML format, including the partially tagged consolidated financial statements as included in the reporting package by SBM Offshore N.V., has been prepared in all material respects in accordance with the RTS on ESEF. The Management Board is responsible for preparing the annual report, including the financial statements, in accordance with the RTS on ESEF, whereby the Management Board combines the various components into a single reporting package. Our responsibility is to obtain reasonable assurance for our opinion whether the annual report in this reporting package, is in accordance with the RTS on ESEF. Our procedures, taking into account Alert 43 of the NBA (Royal Netherlands Institute of Chartered Accountants), included amongst others:

|

|

No prohibited non-audit services |

|

To the best of our knowledge and belief, we have not provided prohibited non-audit services as referred to in article 5(1) of the European Regulation on specific requirements regarding statutory audit of public-interest entities. |

|

Services rendered |

|

The services, in addition to the audit, that we have provided to the Company or its controlled entities, for the period to which our statutory audit relates, are disclosed in note 4.3.33 to the financial statements. |

|

Responsibilities for the financial statements and the audit |

|---|

|

Responsibilities of the Management Board and the Supervisory Board for the financial statements |

|

The Management Board is responsible for:

|

|

As part of the preparation of the financial statements, the Management Board is responsible for assessing the Company’s ability to continue as a going concern. Based on the financial reporting frameworks mentioned, the Management Board should prepare the financial statements using the going-concern basis of accounting unless the Management Board either intends to liquidate the Company or to cease operations or has no realistic alternative but to do so. The Management Board should disclose in the financial statements any event and circumstances that may cast significant doubt on the Company’s ability to continue as a going concern. |

|

The Supervisory Board is responsible for overseeing the Company’s financial reporting process. |

|

Our responsibilities for the audit of the financial statements |

|

Our responsibility is to plan and perform an audit engagement in a manner that allows us to obtain sufficient and appropriate audit evidence to provide a basis for our opinion. Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high but not absolute level of assurance, which makes it possible that we may not detect all material misstatements. Misstatements may arise due to fraud or error. They are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements. |

|

Materiality affects the nature, timing and extent of our audit procedures and the evaluation of the effect of identified misstatements on our opinion. |

|

A more detailed description of our responsibilities is set out in the appendix to our report. |

|

Rotterdam, 9 February 2022 PricewaterhouseCoopers Accountants N.V. |

|

Original signed by |

|

A.A. Meijer RA |

|

Appendix to our auditor’s report on the financial statements 2021 of SBM Offshore N.V. |

|---|

|

In addition to what is included in our auditor’s report, we have further set out in this appendix our responsibilities for the audit of the financial statements and explained what an audit involves. |

|

The auditor’s responsibilities for the audit of the financial statements |

|

We have exercised professional judgement and have maintained professional scepticism throughout the audit in accordance with Dutch Standards on Auditing, ethical requirements and independence requirements. Our audit consisted, among other things of the following:

Considering our ultimate responsibility for the opinion on the consolidated financial statements, we are responsible for the direction, supervision and performance of the group audit. In this context, we have determined the nature and extent of the audit procedures for components of the Group to ensure that we performed enough work to be able to give an opinion on the financial statements as a whole. Determining factors are the geographic structure of the Group, the significance and/or risk profile of group entities or activities, the accounting processes and controls, and the industry in which the Group operates. On this basis, we selected group entities for which an audit or review of financial information or specific balances was considered necessary. |

|

We communicate with the Supervisory Board regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit. In this respect, we also issue an additional report to the audit committee in accordance with article 11 of the EU Regulation on specific requirements regarding statutory audit of public-interest entities. The information included in this additional report is consistent with our audit opinion in this auditor’s report. |

|

We provide the Supervisory Board with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related actions taken to eliminate threats or safeguards applied. |

|

From the matters communicated with the Supervisory Board, we determine those matters that were of most significance in the audit of the financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, not communicating the matter is in the public interest. |